Central KYC is a new concept introduced by Govt. of India to reduce the efforts of the individual to submit various records to prove the identity of a person. When we do investment or take a loan / credit card / purchase a mutual fund /insurance, we are supposed to submit a set of documents to prove your identity, address and photograph as part of the KYC (Know Your Customer) requirements. The above we need to do at every new company or firm we do business with. Central Govt. has introduced an easy and new method to reduce the repeated steps by introducing the CKYC number.

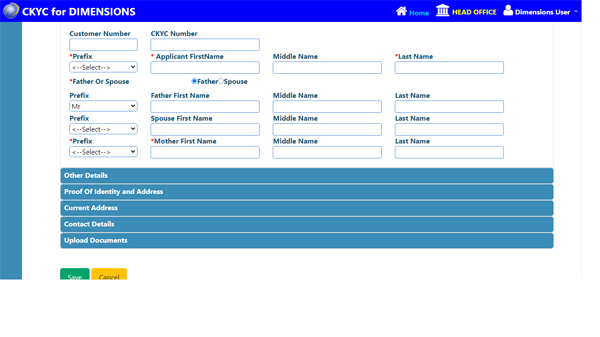

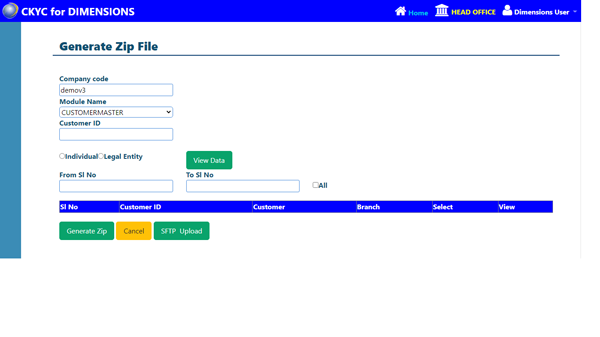

Customer details such as, Customer Name, Father’s Name, Mother’s Name, Date of Birth, PAN or Form 60, Residential Status, Account Type, Proof of Identity Document Name, Identity Document Number, Identity Document’s Expiry Date, if any, Proof of Address, Address, Town / City, Pin code, District, State, Country, which are mandatory as per CERSAI’s CKYC as well as non-mandatory details such as Contact details, etc., along with document images are captured in Customer Data Entry. Customer details are then zipped. This zip is used by FI to upload to CERSAI’s CKYC site.

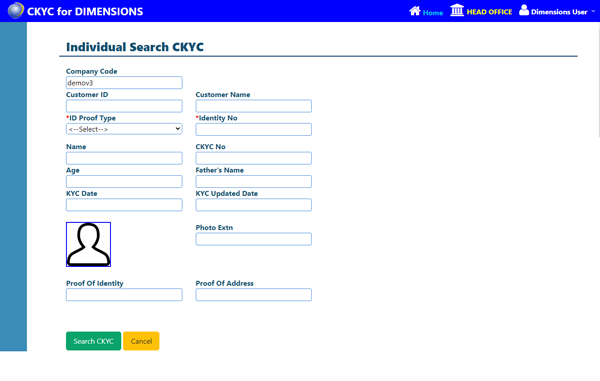

Using a Customer’s Identity Document Number, Search is done via the API provided by CERSAI, using FI’s Document Digital Signature (which is installed in Dimension’s server and this server is white listed by CERSAI’s CKYC site). If this customer’s details already exist in central repository, then Search response from CKYC are CKYC Number, Name, Age, Father’s Name, KYC Date, KYC Update Date, Photo Extension, Photograph, Names of Proof of Identity document and Proof of Address document submitted. Search gives us the option to capture CKYC Number and hence no document is required to be uploaded.

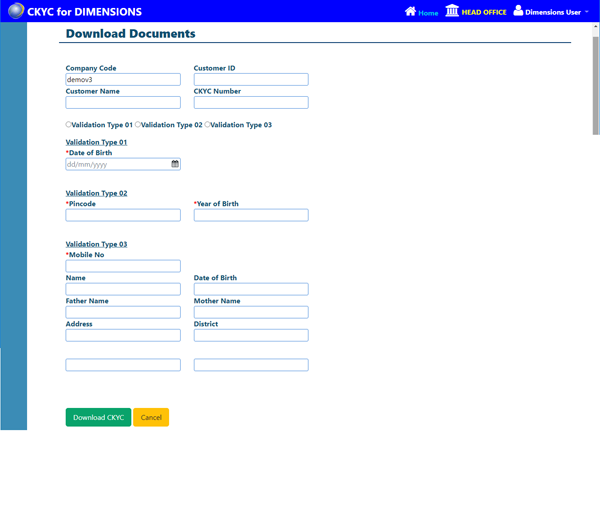

Using a Customer’s CKYC Number, it is possible to download all the details, including document images, without having to collect the same from the customer. Download is done via the API provided by CERSAI, using FI’s Document Digital Signature (which is installed in Dimension’s server and this server is white listed by CERSAI’s CKYC site). In addition to CKYC Number, there are 3 validation options of which one has to be provided, to download the customer details. The validations are: CKYC No and (1) Date of Birth or CKYC No and (2) Pin Code and Year of Birth or CKYC No and (3) Mobile No. The API will return all details of the customer both mandatory and non-mandatory (as mentioned in Customer Upload), which have been uploaded by some other agent, including all the images, minimum two ie; Proof of Identity and Photograph.

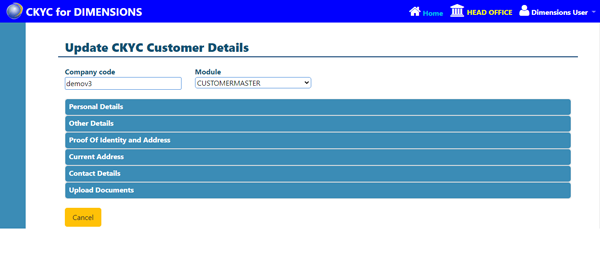

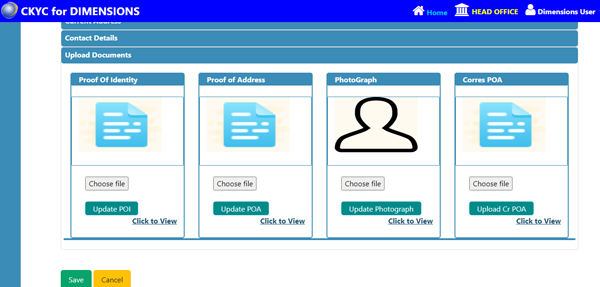

While downloading Data through the download function you may get documents which are expired for example a customer has uploaded his data to CKYC portal though a Financial Institution 5 years back at that time he has given his passport as POI / POA now when you download his passport might have expired so in place of the old document you can update the new passport. Similarly, any correction in data due to such events described above or by mistake a wrong data has gone into for can be corrected by an FI through this method for INDIVIDUAL CUSTOMERS.

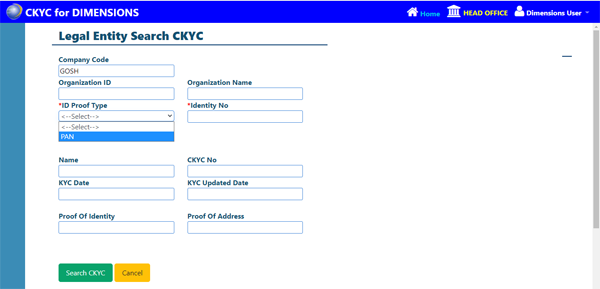

Details such as Organization’s Name, Constitution Type (as mentioned by CKYC), Date of Incorporation, Place of Incorporation, Business Start Date, Country of Incorporation, TIN/GST Registration No, TIN issuing Country, PAN Number or Form 60, Address, Town / City, Pin code, District, State, Country, Proof of Identity and Identity Number, Proof of Address which are mandatory and non-mandatory data such as Contact details, Related Personnel details (as specified by CKYC ) etc., including document images are captured in Legal Entity Details.

Details of Organizations are zipped and uploaded by FI to CERSAI’s CKYC site.

The Documents for Legal Entity Search will be of the following types.

Using CKYC Number and other criteria specified by CKYC, it will be possible to Download the details of an organisation.

While downloading Data through the download function you may get documents which are expired for example a customer has uploaded his data to CKYC portal through a Financial Institution 5 years back at that time the office addresses was different now when you download you found the address is changed so in place of the old supporting document you can update the new document for updating of data. Once you do that all future events the data is correct until further correction comes. Similarly, if there is any change in director details or related persons details you can do and update of such data only or if you find any mistake in the LEGAL ENTITY DATA after downloading, Financial Institution can correct though this method for LEGAL ENTITY UPDATE.

Apart from using our CKYC portal application you can get into the AI route for companies who can take up the API integration route and our interface as a HYBRID model.

Search and Download functions are available separately as well.

We also have a full API route where filing search/download and update are available through the API route. This also can be utilised by software companies and Financial Institution can integrate this though their ERP provider or IT department. Here very high level of automation is possible more or less 95% automation can be done. Your IT is relieved from difficult task or preparing the data and digitally singing every time etc.

Copyright 2025 © Dimensionsgroup. All rights reserved,